Higher Retirement Age, Debts and Other Things that Bother Canadian Seniors

Jun 20, 2017 | Featured, Business

Ukrainian Credit Union.

Every year, a variety of investment firms provide surveys on a variety of investment topics, and one in particular focused on Canadians who are near, or already in, retirement as to how they approach this next stage of their lives. The 2017 investment survey brought some interesting result that should be useful for everyone to take note of in terms of household financial planning.

First, it appears that a large part of currently retired people (about 45%) took early retirement (before the age of 60). About 50% of people in this category retired due to job changes or for medical reasons. Yet, a good portion of them also took early retirement because they were financially ready (around 15%) or wanted to pursue their other interests outside of work (around 14%).

At the same time, those who are not yet retired but are close to retiring now are overwhelmingly planning to retire at the age of 65 (about 42%) and older (21%). This, probably, speaks to the changes in Canadian pension rules extending the official retirement age to 67, which are being discussed currently. Or it may speak to the worsening financial conditions of households, or poorer expectations about future personal levels of wealth. People, who find themselves in either of these two categories should seek professional financial advice.

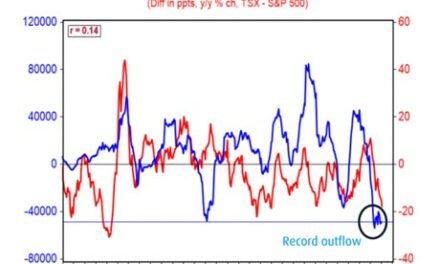

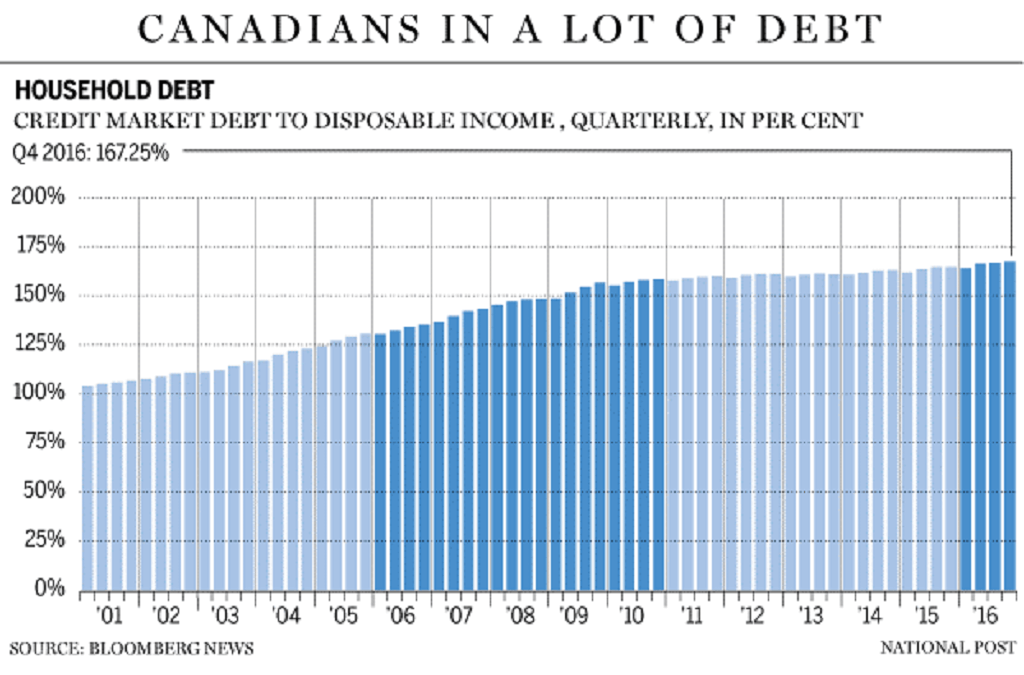

One of the major factors which affect the well-being of retirees is debt. The survey showed that 28% of Canadian retirees carry a mortgage on their principal property into retirement. The survey report notes that mortgage debt, coupled with the costs associated with home ownership, can significantly affect one’s retirement plan and limit one’s choices in retirement. This factor is becoming increasingly important in Canada where the growth of household debt has recently spiked: total household debt, including consumer credit, mortgage and non-mortgage loans, as of late 2016 exceeded $2.0 trillion or 167% of household adjusted disposable income in the fourth quarter.

Share on Social Media